Shared from www.fox-risk.com

Over the last 25 years of working in Enterprise Risk Management (ERM) and project/programme risk, I’ve often found myself questioning whether the work I was doing was truly effective or beneficial.

At first glance, this might sound like an admission of failure—but it’s not. Let me explain.

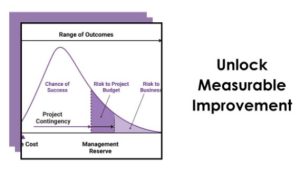

In my career as an international risk management consultant, I’ve worked across a wide range of sectors, supporting mega-projects, massive infrastructure programmes, and corporate ERM initiatives. Despite this diversity, one thing has been clear: only when Quantitative Risk Analysis (QRA) was applied did the evidence of risk management’s effectiveness become visible.

Organisations and projects that embraced QRA gained the ability to understand the total cost of risk and measure the return on investment for mitigation efforts. This tangible data allowed them to make informed, financially sound decisions.

The Limitations of Purely Qualitative Risk Analysis

On the other hand, organisations relying solely on qualitative methods—think heat maps, risk lists, and supposed “best practice” frameworks—faced significant limitations. While these methods provided structure and a sense of order, they lacked the ability to measure improvement in risk exposure or evaluate whether mitigation efforts were cost-effective.

These organisations often had well-documented processes, but their leaders rarely leveraged the risk data for meaningful decision-making. Sure, qualitative risk management might improve communication or foster consensus, but is that enough?

To draw a provocative comparison: astrology has a structured methodology too, but very few business leaders base critical decisions on star signs. In the same vein, relying solely on qualitative risk analysis is not a strong foundation for decision-making in today’s complex and uncertain business environment.

Why New Zealand Needs to Embrace QRA

In 2025, my mission is to help more New Zealand organisations transition to Quantitative Risk Analysis and realise the benefits of a measurable, accountable risk management process. A process that speaks their language—numbers, probabilities, and actionable insights—and enables informed, strategic decisions.

At Fox-Risk, I am committed to driving this shift. Over the coming months, I will be publishing a series of articles that demystify QRA and guide organisations in moving from a qualitative, heat map-based approach to a robust quantitative system.

What’s Coming in the Series

In this series, we’ll cover:

- The key differences between qualitative and quantitative risk analysis.

- Why and how uncertainty should be measured.

- Demystifying Monte Carlo analysis—what it is (and what it’s not).

- The psychology of uncertainty and how it affects decision-making.

- Practical steps to improve your subject matter experts’ ability to estimate uncertainty accurately.

- Simple, actionable methods to transition from qualitative to quantitative risk management.

- Tools and resources to support your journey.

Join the Movement

If you’d like to receive these insights directly in your inbox, send me a LinkedIn message or email [email protected], and I’ll add you to our mailing list. Click for more risk articles BLOGs | Fox-Risk Consultancy

I’m also thrilled to share that I’ll be (hopefully) presenting on this topic at the New Zealand Risk and Resilience Summit 2025 – RiskNZ in July. Stay tuned for more details, and I hope to see you there.

Together, let’s take risk management in New Zealand to the next level—making it measurable, accountable, and a true driver of business value.